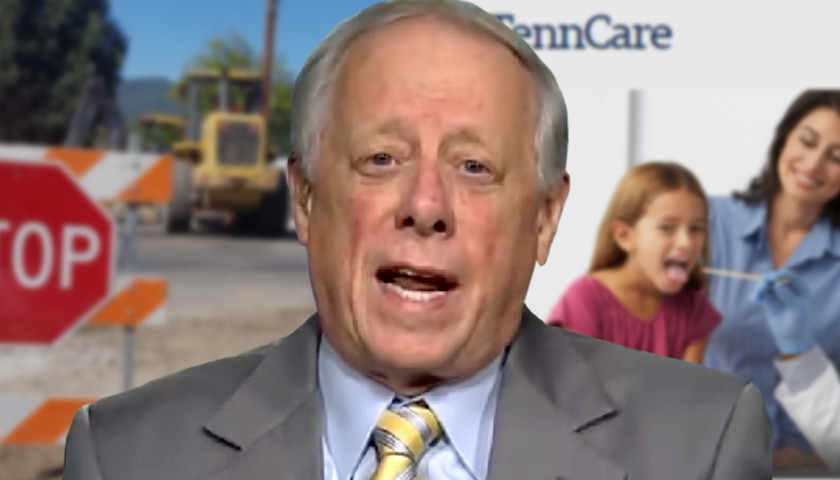

Last week, Tennessee’s former Governor Phil Bredesen announced that he would run for the U.S. Senate seat currently held by retiring Sen. Bob Corker (R-TN) in the 2018 election.

Even though Bredesen is a Democrat and Corker is a Republican, both disfavor President Trump, both have no aversion to raising taxes, and both are okay with diverting transportation money for non-roadway projects.

By the time Bredesen left the governor’s office in 2009 after eight years in the job, several tax increases had been put on cigarettes and certain managed care companies. Other revenues were raised in the form of fee increases.

Corker proposed raising the federal fuel tax in 2014. Congress hasn’t raised the federal gas tax since 1993, and in 1998, over $8 billion was diverted from the Highway Trust Fund (HTF) to the general fund. This was before Corker’s time, but he still pushed his gas tax increase without tackling the diversion of HTF money for non-highway projects:

A Government Accountability Office report found that 32% of the HTF didn’t go toward highway or bridge construction and upkeep from fiscal 2004-08. That rose to 38% in 2009, according to an analysis by Ron Utt, senior research fellow at the conservative Heritage Foundation.

In Tennessee, Bredesen diverted road money to balance the budget and help pay for TennCare. In 2015, state Senator Jim Tracy, chairman of the Senate Transportation Committee confirmed that the $280 million dollars “raided” from the state’s highway fund between 2001 and 2007, had not been restored:

This money should have never been diverted for other state government purposes and should have been paid back at the first available opportunity. Instead, we still have a $280 million hole at a time when we are struggling greatly to fund repairs and priority projects. It’s past time for these funds to be paid back.

During the last two fiscal years of the Sundquist administration $30 million each year was transferred from the highway fund to the general fund in contrast to the first two years of the Bredesen administration when $65.8 million each fiscal year was taken from the highway fund. Bredesen’s raid on transportation money continued in his second term as well; “in the 2005-2006 budget $55.8 million was raided for general fund purposes, while $32.8 million was taken during the 2006-2007 fiscal year” bringing the total Bredesen raid to over $22o million dollars.

At the same time Bredesen was diverting road money he rejected a gas tax increase as a way to replenish the overdrafted fund.

He was, however, willing to consider toll roads and toll bridges and did succeed in breaking with the state’s “pay as you go” practice by working out a deal to issue bonds for bridges. He also relied on federal stimulus funds to accomplish certain TDOT projects. There was speculation that after Sundquist’s debacle on an attempted state income tax and with Republicans gaining a House majority in 2007 and a Senate majority in 2008, that Bredesen’s prospect for success on a gas tax increase was at best, uncertain.

By the time Bredesen was term-limited, the state’s transportation funding problems remained unresolved and according to Sen. Tracy, the fund shorted by $280 million dollars.

Haslam’s initial push for the gas tax was subtle; in December 2014, he stressed that without new transportation money, there would likely be no new road or bridge construction, or as TDOT Commissioner Jim Schroer put it, Tennessee would become a “maintenance only state.”

In 2017, with State Rep. Barry “Boss” Doss ramming through the gas tax increase bill in the Tennessee House and the quick acquiescence of the Senate Transportation Committee, Haslam’s IMPROVE fuel tax increase was passed.

We got to keep this guy from getting elected.

There was also a no bid contract to a key campaign and well-known Democrat party contributor to perform background checks for THP if I recall correctly as well.